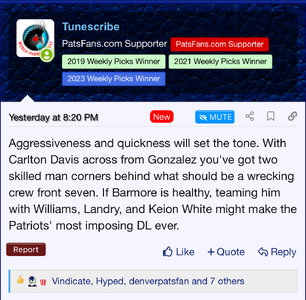

“It’s Taxachusetts,” Belichick said, drawing laughs Monday from Pat McAfee and A.J. Hawk during an

appearance on The Pat McAfee Show. “They take more from you.”

Barreling into his new life as an out-of-work coach and commentator, Belichick was opining Monday on the variables that players and teams face when weighing career moves, trades, signings, and the off-the-field factors than can play a role in decision-making.

It was at that point in the interview that Belichick brought up “the millionaire’s tax,” as he called it, referring to the new 4 percent tax on household income above $1 million per year that Massachusetts voters approved after Democrats pushed it to the ballot in 2022.

The surtax, which comes on top of the state’s flat 5 percent tax on all income above $8,000, generated $2.2 billion in fiscal 2024. It

drove most of the 8.6 percent growth in tax receipts for the year, pulling more money from CEOs and other big earners like Jaylen Brown and Jayson Tatum of the Boston Celtics, but also from a slew of lower-profile wealthy families.

Belichick surfaced the tax issue when talking about CeeDee Lamb, who this week signed a four-year $136 million contract extension that will enable him to stay with the Dallas Cowboys and become one of the highest-paid wide receivers in the NFL.

“Dallas is a pretty good situation,” Belichick said. “Got a great quarterback, got a good team, got a lot going for you. Does he want as much money as possible? Yeah, of course. But is it really worth it to go out of town to wherever and not be playing in the environment and the opportunity that he has there in Dallas? A decision you have to make as a player, like … you want to try to get as much as you can from the team you want to be with. If you’re already on that team, then how much is it really worth by the time you move, you know, pay your 50 percent tax, or your millionaire’s tax in New England, you got that one too. You know, what’s really a differential?”